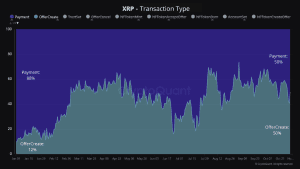

XRP Ledger’s Evolving Use Case: OfferCreate Transactions Surge to Over 50%

The XRP Ledger (XRPL), developed by Ripple, has long been recognized for facilitating cross-border payments. However, recent data reveals a significant shift in its usage, highlighting its evolving role within the crypto ecosystem. According to a report from CryptoQuant, over 50% of transactions on the XRP Ledger are now categorized as OfferCreate Transactions, marking a notable departure from the traditional payment-dominant usage.

A Shift in Transaction Trends

At the start of the year, a substantial 88% of transactions on XRPL were payments, with only 12% being OfferCreate Transactions. Fast forward to now, and the balance has shifted, with both types of transactions each accounting for 50%. This change points to growing interest in XRPL’s expanded capabilities beyond simple payments, as more market participants leverage its decentralized exchange (DEX) functionalities and asset issuance capabilities.

Why This Matters: The rise in OfferCreate Transactions signifies that users are increasingly utilizing the XRP Ledger for more sophisticated trading strategies and financial activities. As these features gain traction, they could contribute to a broader adoption of the XRPL ecosystem and potentially impact XRP’s value.

XRP Price Action: Retesting $0.50

Amid these developments, XRP is currently retesting the $0.50 price level as support. This level is crucial for the cryptocurrency, and maintaining it could signal increased accumulation by traders and investors. Analysts like CryptoQuant’s “maartunn” suggest that the uptick in complex usage on the XRPL could drive this accumulation, potentially influencing price trends in the near future.

The Role of Ripple’s RLUSD Stablecoin

Ripple is set to further expand the functionality of the XRP Ledger with the upcoming launch of its RLUSD stablecoin. This new asset will be introduced on both the XRP Ledger and Ethereum blockchain, with testing expected to begin soon. The process will involve minting and burning mechanisms across both networks, introducing fresh utility for users and potentially spurring further activity on XRPL.

Implications of RLUSD: The addition of RLUSD is a strategic move that could reinforce the XRPL’s role in the broader blockchain ecosystem, providing stability and utility for decentralized finance (DeFi) applications. This aligns with the ongoing shift in how the XRP Ledger is used, moving from a payment-centric network to one supporting more comprehensive financial strategies.

What This Means for the Future

The evolution of the XRP Ledger highlights the dynamic nature of blockchain technology and its ability to adapt to user needs. The increasing diversity in transaction types signals a maturing ecosystem where users are exploring more complex applications, such as asset issuance and DEX trading. This could be a positive indicator for the network’s growth and the potential value of XRP as utility and engagement rise.

Key Takeaway: The XRP Ledger’s diversification into asset issuance and DEX functionalities showcases its potential beyond payments. With the introduction of the RLUSD stablecoin and a surge in OfferCreate Transactions, the stage is set for continued growth and adoption of the XRPL ecosystem.

Disclosure: This article is for informational purposes only and does not represent investment advice. Readers are encouraged to conduct their own research before making any financial decisions.