Top Solana Memecoins WIF and POPCAT Drop to Key Support Levels – What to Expect Ahead?

Both tokens are now at key support levels, suggesting a potential opportunity for a reversal or further downward movement. Let’s dive into the technical analysis to understand the possible scenarios for these tokens in the days ahead.

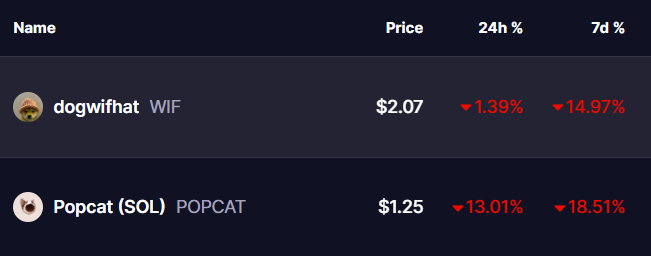

Dogwifhat (WIF)

- Current Price: $2.07

- Support Level (S): $1.96

- Resistance Level (R): $2.36

WIF has dropped to the $2.07 level after failing to hold above the previous support. This brings it near the significant support level of $1.96, where buyers might step in to defend this price point. The Relative Strength Index (RSI) is showing oversold conditions, indicating potential buying interest at this level.

If WIF can hold above $1.96, we could see a recovery towards the resistance at $2.36. However, if the selling pressure continues and it breaks below $1.96, a deeper pullback could be expected, potentially bringing the price towards lower support zone at $1.65.

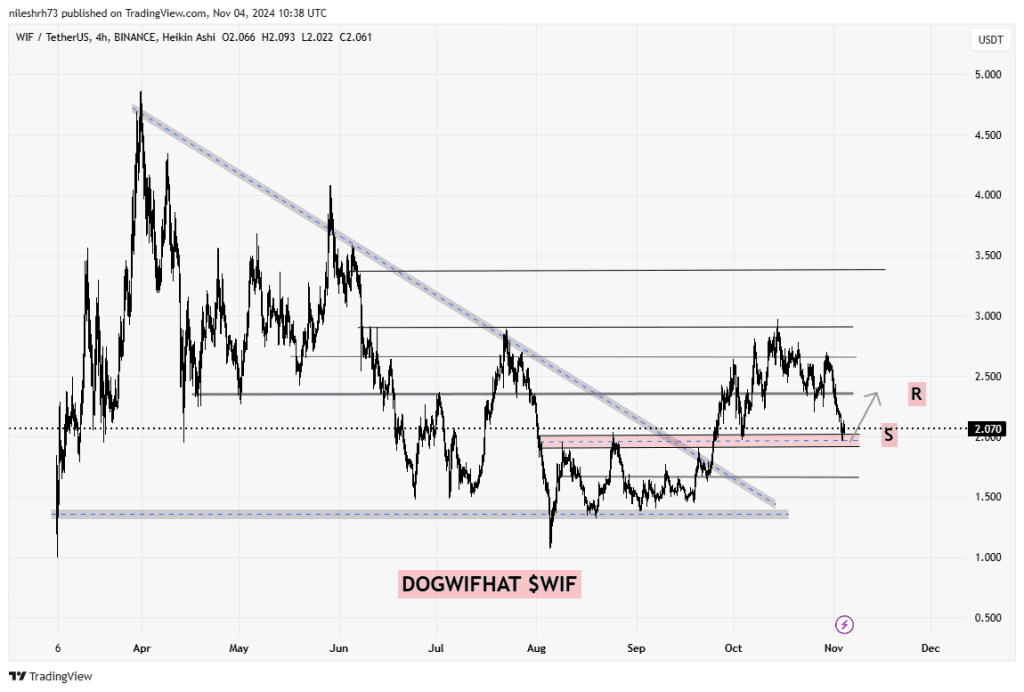

Popcat (POPCAT)

- Current Price: $1.25

- Support Level (S): $1.21 $ $1.15

- Resistance Level (R): $1.43

POPCAT has also come under selling pressure, currently trading around $1.25, slightly above its critical support level at $1.21. The price action suggests that buyers are losing control, but a potential reversal could be in play if this level holds. The RSI is low, reflecting oversold conditions similar to WIF.

If POPCAT manages to reclaim and stay above $1.21 and $1.15, it may aim for the next resistance at $1.43. However, failing to maintain the $1.21 support could result in further declines.

What to Expect Ahead?

The broader market sentiment remains cautious due to external factors like the U.S. elections. If the sentiment improves, it could provide the necessary push for both WIF and POPCAT to recover from their current lows. Otherwise, continued uncertainty could weigh on these assets.

Conclusion

While WIF and POPCAT have fallen to critical support levels, their fate depends largely on market sentiment and whether buyers can defend these levels. Investors should monitor the support and resistance areas closely for any breakout or breakdown signals.