Payment Calculator EMI Calc

Use Online Free

Loan Payment Calculator

Payment Summary

$0.00

Monthly Payment

Enter your loan details and click calculate to see your payment breakdown.

| Loan Amount | $0.00 |

| Total Interest | $0.00 |

| Total Payments | $0.00 |

Payment Breakdown

| Period | Payment | Principal | Interest | Total Interest | Balance |

|---|

Understanding Loan Options: Fixed Term, Monthly Payments, and Interest Rates

When it comes to borrowing money, whether for a home, car, or other financial needs, choosing the right loan is crucial. Loans are essentially agreements between a borrower and a lender, where the borrower receives a sum of money (the principal) that must be repaid over time. With so many options available, navigating these decisions can be overwhelming. The two most common factors to consider are loan term and monthly payment amount, both of which can significantly impact your financial future.

Fixed Term Loans: Long-Term Financial Planning

Fixed-term loans are one of the most popular loan types, often used for mortgages, auto loans, and other large purchases. These loans are designed with a set repayment period, where borrowers make monthly payments over a specified number of years. Mortgages, for example, are typically offered in 15- or 30-year terms. The length of the term can significantly affect your financial goals.

- Shorter Terms for Stability: Some people choose shorter mortgage terms due to the uncertainty of long-term job security or to take advantage of lower interest rates. For example, a 15-year mortgage typically comes with a lower interest rate than a 30-year mortgage, saving you money in the long run if you can handle higher monthly payments.

- Longer Terms for Flexibility: Conversely, choosing a longer mortgage term can help align the loan payoff with future financial plans, such as timing the mortgage’s completion with Social Security benefits or other long-term income sources.

For auto loans, term lengths can range from as short as 12 months to as long as 96 months. While longer terms reduce monthly payments, shorter terms generally result in less interest paid over time. A payment calculator can help you determine the best loan term based on your budget.

Fixed Monthly Payment Amount: Accelerate Your Loan Payoff

Another approach to loan repayment is focusing on fixed monthly payments. This method allows you to see how long it will take to pay off a loan with a set monthly amount. This strategy is especially useful for paying off credit card debt. For example, if you have extra money at the end of the month, you can apply it to your loan to pay off your debt faster.

One thing to note is that if your monthly payment is too low, it may not be enough to cover the interest and principal on the loan, which could lead to accruing more interest over time. In such cases, you can adjust variables like the loan amount, monthly payment, or interest rate to ensure a viable repayment plan.

Understanding Interest Rate vs. APR

When calculating loan costs, it’s important to understand the difference between interest rate and annual percentage rate (APR).

- Interest Rate: This is the cost of borrowing the principal loan amount.

- APR: A more comprehensive measure, APR includes additional fees such as closing costs, administrative fees, and broker charges. These fees are rolled into the loan and spread out over the term.

In general, the APR provides a more accurate estimate of the true cost of a loan, particularly for large loans like mortgages. If no fees are involved, the interest rate and APR will be the same. Be sure to check both figures to make the best financial decision.

Variable vs. Fixed Interest Rates

Loans typically come with either fixed or variable interest rates. Understanding the pros and cons of each can help you make the right choice.

- Fixed Rate Loans: The interest rate remains constant over the life of the loan. These are common for mortgages, auto loans, and student loans.

- Variable Rate Loans: The interest rate can fluctuate based on external factors, such as inflation or the U.S. Federal Reserve’s key index rate. Examples include adjustable-rate mortgages (ARMs), home equity lines of credit (HELOC), and certain personal loans.

With variable-rate loans, your monthly payment and total interest owed can change over time. Some lenders may impose caps on interest rate increases, ensuring that rates don’t skyrocket even if the economy changes. Variable rates can be beneficial when interest rates are trending downward but may cause higher payments when rates rise.

Making Informed Decisions

Choosing the right loan can be complex, but understanding your options helps. A payment calculator is a powerful tool to help you sort out the fine details, whether you’re deciding between mortgage terms, auto loan options, or paying off credit card debt. Don’t forget to factor in the total cost of borrowing, including both the interest rate and any associated fees, for a more comprehensive understanding of your loan.

If you’re looking for additional tools, consider checking out a mortgage calculator for home loans, an auto loan calculator for vehicle financing, or a credit card payoff calculator to manage credit card debt.

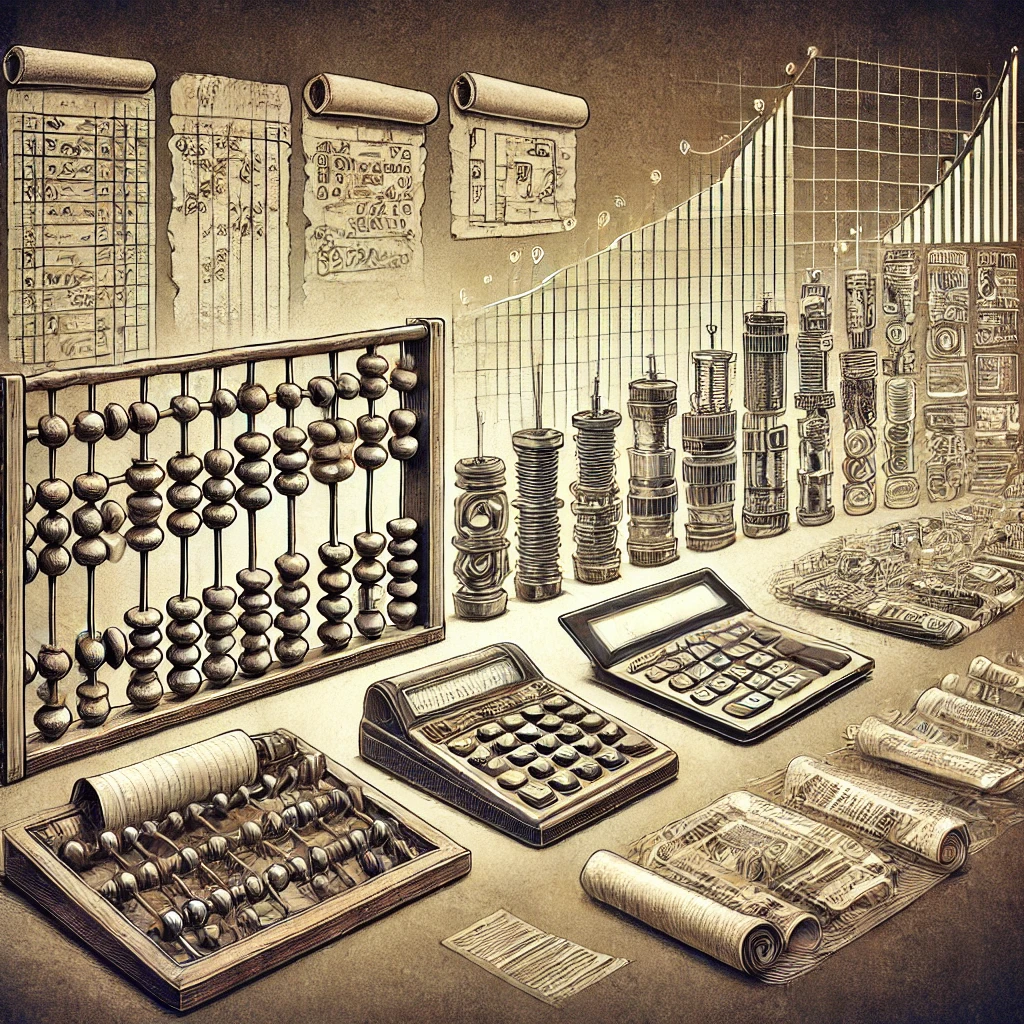

The History of Payment Calculators (EMI Calc): From Early Lending to Modern Tools

Payment calculators (EMI Calc) have become a cornerstone of modern financial decision-making, evolving significantly over time. From the earliest methods of calculating interest in ancient civilizations to today’s sophisticated online payment calculators, the journey tells a compelling story about the evolution of lending practices and technology.

Ancient Times: The Birth of Interest Calculations

The concept of lending and calculating interest can be traced back to ancient civilizations. Early forms of interest calculations, though not as advanced as modern payment calculators (EMI Calc), were pivotal in shaping today’s financial tools. Around 3,000 BC in Mesopotamia, merchants and lenders used tools like the abacus to track debts and payments. Loans often involved commodities like grain or livestock, with interest rates set by local laws or customs.

In Ancient Greece and Rome, lending practices became more formalized. Roman law introduced the concept of “foenus” or interest. While ancient civilizations lacked payment calculators, they used standardized systems for determining loan amounts and repayments, often through oral agreements or written contracts.

The Middle Ages: Formalizing Lending Practices

During the Middle Ages, the role of banking grew, and methods for calculating loan payments became more sophisticated. Although payment calculators (EMI Calc) did not yet exist, the introduction of ledger books helped in tracking credit, loans, and interest. The Medici family revolutionized banking in Italy by formalizing systems for tracking loans and payments.

The development of compound interest during this period laid the groundwork for more advanced payment calculators. This method, though more complex, paved the way for the later development of tools designed to calculate loan terms and payments.

18th Century: The Rise of Mathematical Tools for Lending

The 18th century saw a major leap in lending with the rise of financial mathematics. Pioneers like Isaac Newton and Edmond Halley contributed to early actuarial science, which remains foundational in today’s payment calculators (EMI Calc).

During this time, tables for calculating fixed payments on loans emerged. These tables allowed lenders and borrowers to easily compute repayment amounts, a precursor to modern payment calculators. This leap toward automation was a critical step in the evolution of EMI calculators used today.

Early 20th Century: The First Mechanical Calculators

In the early 20th century, the introduction of mechanical calculators revolutionized how loans were calculated. Machines like the Comptometer and Marchant Calculator could perform arithmetic operations that simplified loan calculations. These early tools laid the foundation for the digital payment calculators (EMI Calc) we now rely on.

Banks and financial institutions adopted these calculators to compute mortgage payments, personal loans, and auto loans. Though they required manual operation, these machines were an essential bridge toward today’s automated EMI calculators.

The Digital Revolution: The Advent of Online Payment Calculators (EMI Calc)

The rise of computers in the mid-20th century ushered in the digital age, transforming the landscape of loan calculations. By the 1970s, electronic calculators were widely available, allowing both professionals and consumers to compute loan payments easily. Early digital calculators from companies like Casio and Texas Instruments made complex calculations accessible, including those related to interest rates and repayment schedules.

As personal computers became more common in homes and businesses, financial software enabled consumers to create custom models for loan payments. The 1990s saw the introduction of online payment calculators (EMI Calc), making loan calculations even more convenient.

Today: Advanced Online Payment Calculators (EMI Calc)

Today’s payment calculators (EMI Calc) have evolved into highly sophisticated tools that anyone can use. Available online, these calculators have become standard on websites for banks, mortgage brokers, and auto lenders. Users can input their loan amount, interest rate, and term length to instantly generate detailed payment schedules, amortization tables, and the total interest owed over the loan’s life.

Modern payment calculators (EMI Calc) offer advanced features, such as:

- Amortization schedules: Breakdown of principal and interest for each payment.

- APR calculators: Accurate estimates of total borrowing costs, including fees.

- Extra payment options: Users can see how additional payments shorten the loan term and reduce interest.

Mobile apps and websites now offer these EMI calculators, providing real-time access to financial tools. This convenience allows consumers to make informed loan decisions whether they’re at home, in a bank, or on the go.

Conclusion: From the Abacus to Modern EMI Calculators

The history of payment calculators (EMI Calc) mirrors humanity’s progress in finance and mathematics. From ancient abacuses to today’s AI-powered EMI calculators, the ability to calculate loan payments has come a long way. These modern tools now offer unmatched convenience and accuracy, helping consumers make smarter financial choices with just a few clicks.