Choosing the right accounting software for your business isn’t easy. With so many options out there, it’s tough to spot the differences. If you pick one and realize it’s not right for you, switching can be a headache—which makes it a good reason to get it right from the start. Ahead, find a list of the best accounting software for small businesses in 2024.

7 best small-business accounting software to consider

1. Wave: Best free accounting software

For new and independent businesses just starting out, managing expenses is crucial. While many accounting tools come with a cost, Wave stands out by offering a robust solution that won’t touch your wallet—it’s completely free.

→ Click Here to Launch Your Online Business with Shopify

Wave is highly versatile. Whether you’re on a desktop using Windows or the latest Mac OS, or on the move with an Android or iOS device, it has you covered. Plus, its cloud-based web application ensures you can access your accounts from anywhere.

Wave Accounting comes packed with all the essential features, including banking reconciliation, expense management, invoicing, and payroll. This means it can do nearly everything premium accounting tools can do (without adding any cost).

Pros:

- Free to use

- Double-entry reports

- Customizable invoice templates

- Dedicated mobile invoicing

- Unlimited users and permissions

Cons:

- Live chat only for paid add-ons

- No planned feature updates

- Lacks advanced options

- No phone support

Price: Starter plan is free; Pro Plan starts at $20/month

Free trial length: n/a

Mobile app: iOS, Android

Shopify app/integration: No

2. FreshBooks: Best accounting software for service-based businesses

FreshBooks is a well-known small business accounting tool that offers automated functions and smart features to minimize manual work. For instance, you can configure it to automatically reconcile debit and credit amounts, as well as import data from varying sources.

Additionally, the tool makes it simple to access key statements like: cash flow statements, income statements, and balance sheets.

Moreover, you can tailor access for different team members. While employees might have restricted access to financial statements, accountants can be given broader administrative rights.

Pros:

- Excellent customer support

- Extensive cloud features

- Time and mileage tracking

Cons:

- Limited users and clients

- Lacks quarterly tax estimates

- No bank reconciliation in basic plans

Price: Plans start at $4.50/month

Free trial length: 30 days

Mobile app: iOS, Android

Shopify app/integration: Yes

3. QuickBooks Online: Best online accounting software

Another popular accounting solution is Intuit’s QuickBooks Online. This tool offers a straightforward interface, making it easy for even novices to navigate their bookkeeping tasks.

At its core, every package includes tools for tracking mileage, income, and expenses, as well as detailed sales and tax reports. Additionally, it provides resources for managing 1099 contractors.

If you want additional features such as inventory tracking or a dedicated customer support manager, consider upgrading to one of QuickBooks Online’s premium plans.

Pros:

- Double-entry accounting system

- Third-party app compatibility

- Abundant learning resources

Cons:

- Steep learning for advanced features

- Costlier monthly plans

- Limited user accounts

Price: Plans start at $15/month

Free trial length: 30 days

Mobile app: iOS, Android

Shopify app/integration: Yes

4. Zoho Books: Best accounting software for beginners

Zoho Books is an excellent choice if you’re looking for software with inventory management, accounts payable, and accounts receivable capabilities. Its invoicing system is fast and reliable, offering most features your business needs. You also get native mobile apps that allow you to manage your finances on the go.

Pros:

- Effective free version

- Comprehensive mobile app

- Competitively priced

- Top-tier multicurrency support

Cons:

- Extra cost for advanced tools

- Restricted user count per tier

- No fixed asset tracking

Price: Free for businesses with an annual revenue of less than $50,000; paid plans start at $15/month

Free trial length: 14 days

Mobile app: iOS, Android

Shopify app/integration: Yes

5. Xero: Accounting software for growing businesses

For small business owners on the move, Xero could be the ideal accounting solution.

Xero offers smart accounting tailored for small businesses, prioritizing simplicity and mobile accessibility. It seamlessly connects across devices, delivering real-time data, so business leaders have the freshest insights, no matter their location.

With a straightforward design, Xero manages tasks like payroll (through a Gusto link), bill management, expense logging, sales tax estimations, and invoicing.

Pros:

- Efficient project tracking

- Detailed financial reports

- Hubdoc (automatic receipt and bills capturing function) in every tier

- Unlimited users in all plans

Cons:

- PayPal transaction delays

- Lacks phone support

- No auto reminders for invoices

Price: Plans start at $15/month

Free trial length: 30 days

Mobile app: iOS, Android

Shopify app/integration: Yes; integrates via third-party apps

6. Kashoo: Best accounting software for process automation

Kashoo’s accounting software works to ease the bookkeeping grind for small businesses.

Utilizing machine learning, Kashoo adapts and learns from your business operations. It efficiently handles tasks, from sorting receipts to monitoring sales tax, and provides tailored advice to grow savings, reduce expenses, and boost operational fluidity.

While Kashoo’s smart hands-off approach may not suit everyone, those intrigued by its accounting features can test it through a free trial.

Pros:

- Easy to use

- Automated admin processes

- Excellent customer support

- Unlimited users

Cons:

- No Android app

- Limited integration options

- Missing time-tracking and inventory

Price: Plans start at $216/year

Free trial length: 30 days

Mobile app: iOS, Android

Shopify app/integration: No

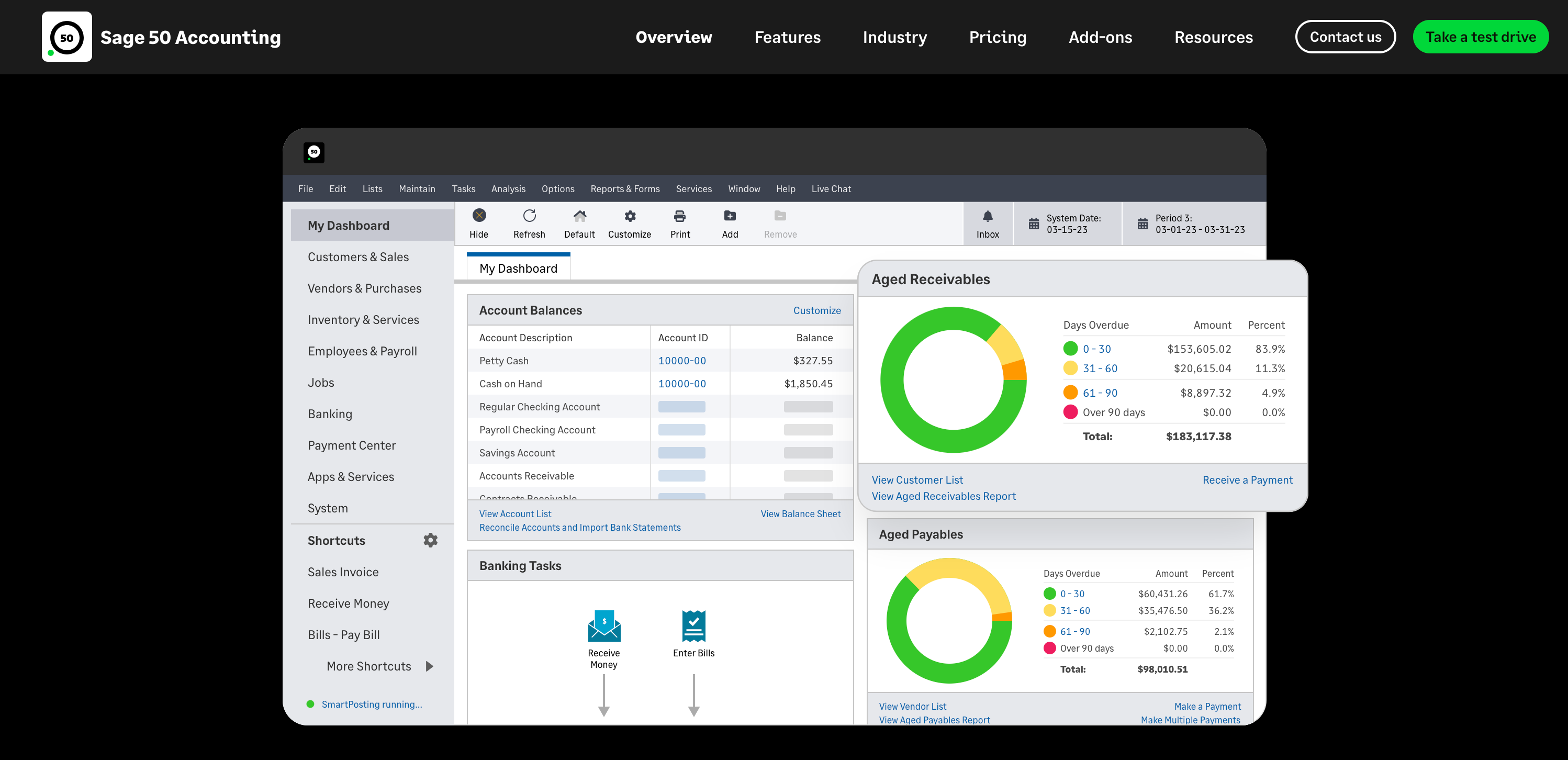

7. Sage 50 Accounting: Best cloud-based accounting software

Sage 50 Accounting offers cloud-based software specifically for small businesses, enhanced by detailed customization and innovative features.

Sage makes daily tasks easier by addressing everything from expense tracking to invoice creation. The software also showcases efficient inventory tracking. An added perk? It integrates seamlessly with Microsoft Office.

Pros:

- Highly customizable

- Inventory management and tracking tools

- Microsoft 365 integration

Cons:

- Clunky UI

- No time tracking options

- No mobile app

Price: Plans start at $58.92/month

Free trial length: n/a live demo available

Mobile app: iOS, Android

Shopify app/integration: No

Efficient accounting equals business growth

When making your choice of accounting software, remember that what works for one business might not fit another.

Some businesses might need robust records of financial transactions, while others may focus on advanced reporting or automated reconciliation. Before committing, ask yourself these questions:

- Does this software handle records of financial transactions the way my business requires?

- Does it provide the level of automation I need?

- Are its reporting features sufficient for my business decisions?

- How well does it manage bank transactions and integration with my financial institution?

You can also take advantage of a few free trials to see which software aligns best with your needs.

Accounting software FAQ

Which accounting software is best for small businesses?

The best accounting software for your small business is one that fulfills your specific requirements. Most businesses choose cloud-based accounting solutions for enhanced security, accessibility, and scalability.

Which online accounting software is the cheapest?

Wave offers online accounting services at no cost. However, it may not have all the features your business requires. That’s why you should always base your decision on your company’s specific needs, rather than just the price tag.

Why is QuickBooks recommended for small businesses?

QuickBooks stands out as a multifaceted accounting solution for small businesses, providing essential features like expense monitoring, inventory oversight, and sales tax tracking, to name a few.